Comparative Study of Classification Techniques on Credit Defaults

A study of six data mining techniques into the Credit Card Defaulter Data -Taiwan (2005)

by, Kousik Somodder, Sagarnil Bose & Shreyashi Saha

Introduction

This project is an attempt toward a comparative study among six different machine- learning models for their accuracy in predicting the target class as well as their accuracy for representing the real probability of an individual belonging to the actual class from the perspective of risk management using the Sorting Smoothing Method. In this project, we summoned the “Default of credit card clients, Taiwan 2005” dataset available at UCI machine-learning repository.

What is Default

When a customer accepts a credit card from a bank or issuer, he/she agrees to certain terms and condition such as he/she needs to make their minimum payment by the due date listed on their credit card statements. If the consumer fails to make the payment for the debt by the due date, the issuer mark the credit card as default and might charge a penulty rate, decreasing credit limit and and in case of serious delniquency, close the account.

How Credit Card Default Happens

Sometimes credit card-issuing banks in order to gain large amount of market share issue credit cards to unqualified clients without suffient information about their ability of repayment of the bills. When the card holders overuse their cards to consume servises and goods irrespective of their repayment ability of the bills, they accumulate a heavy debts.

In the area of consumer finance it is pivotal for the card issuing banks to be able to estimate the chance for a card holder to become default for risk analysis and approving the credit card applications.

Objective

The sole purpose of this project is to compare the six machine-learning models, namely Logistic regression, Discriminant analysis, K-nearest neighbor, Support vector machine, XGBOOST and Artificial neural network based on their accuracy of classification performane and effectiveness in representing the real probability of an individual belonging to the actual class.

For assessment of classification accuracy, different measures such as classification error rate from confusion matrix, ROC curve and area under curve (AUC) are employed. For the assessment of accuracy of predicted probabilities, we’ll use the scatter plot of real probabilities of default(Y) vs predicted probability of default(x) from each of the six techniques. Then fit a linear regression line Y=A+Bx from the scatter plot and decide the best predicting model for which A is closest to 0 and B is closest to 1 and R² is highest.

About The Data Set

Our dataset ‘Default of credit card clients’ consists of informations about transactions from April 2005 to September 2005 of 30000 clients who were credit holders in a bank in Taiwan. This dataset has binary response variable ‘default.payment.next.month’ that takes the value 1 if the corresponding client has default payment and 0 otherwise. Out of 30000 clients 6636(22.12%) were with default payment. There are 23 other independent or explanatory variables:

- LIMIT_BAL: Amount of the given credit(NT dollar), it includes both the individual consumer credit as well as the person’s family credit

- SEX: 1=male and 2= female

- EDUCATION: 1= graduate school, 2= university,3=high-school , 4=others

- MARRIAGE: Marital status. 1=married,2=single, 3= others

- AGE: Age of the client

- PAY_1-PAY_6: History of past payments from April to September 2005. Like PAY_1=The repayment status in September, …., PAY_6=The repayment status of April 2005. The scaling of the status is as follows -2= no transactions history,-1=paid duly,0=revolving ,1=payment delay for one month ,2= payment delay for 2 months ,….,9=payment delay for 9 months or more.

- BILL_AMT1-BILL_AMT6: Amount of bill statement (NT dollar). BILL_AMT1=amount of bill statement in September ,…., BILL_AMT6= amount of bill statement in April 2005.

- PAY_AMT1-PAY_AMT6:Amount of previous payment(NT dollar).PAY_AMT1=amount paid in September ,…., PAY_AMT6=amount paid in April 2005.

Content List

- Loading required packages into the session

- Reading the data into the session

- Having a look at the data, its structure and summary

- Visualization

- Feature engineering

- Data preprocessing and test-train split of the data

- Model fitting

- Prediction on training and test set and computing error rate and AUC

- Plotting ROC curves and cumulative lift charts

- Sorting smoothing method

- Scatter plot and linear regression line fitting and comparison study for the models

- Conclusion

Let’s get started!

Loading Packages

We’ll load some packages into the session first, required in this project. Such as data.table, dplyr for data importing and wrangling, ggplot2, cowplot, pROC,ROCR for visualization of data and diagonistic plotting, caret for models training and several other packages, using library() function. If the package is not installed then it has to be installed using install.packages("package name"). In our case, we have our packages installed, we just need bring them into our session.

##Loading the required libraries

library(data.table)

library(ggplot2)

library(psych)

library(GGally)

library(dplyr)

library(cowplot)

library(caret)

library(pROC)

library(ROCR)

library(MASS)

library(dummies)

library(class)

library(xgboost)

library(e1071)

library(nnet)

We’ll read the data ‘Default of credit card client’ in as a csv file into an object named as credit.

##Reading the data in R session

credit=fread("default of credit card clients.csv")

Let’s take a look at how the first few rows look like as well as the structures of the variables.

##Having a look at the data

str(credit)

head(credit)

Classes ‘data.table’ and 'data.frame': 30000 obs. of 25 variables:

$ ID : int 1 2 3 4 5 6 7 8 9 10 ...

$ LIMIT_BAL : int 20000 120000 90000 50000 50000 50000 500000 100000 140000 20000 ...

$ SEX : int 2 2 2 2 1 1 1 2 2 1 ...

$ EDUCATION : int 2 2 2 2 2 1 1 2 3 3 ...

$ MARRIAGE : int 1 2 2 1 1 2 2 2 1 2 ...

$ AGE : int 24 26 34 37 57 37 29 23 28 35 ...

$ PAY_0 : int 2 -1 0 0 -1 0 0 0 0 -2 ...

$ PAY_2 : int 2 2 0 0 0 0 0 -1 0 -2 ...

$ PAY_3 : int -1 0 0 0 -1 0 0 -1 2 -2 ...

$ PAY_4 : int -1 0 0 0 0 0 0 0 0 -2 ...

$ PAY_5 : int -2 0 0 0 0 0 0 0 0 -1 ...

$ PAY_6 : int -2 2 0 0 0 0 0 -1 0 -1 ...

$ BILL_AMT1 : int 3913 2682 29239 46990 8617 64400 367965 11876 11285 0 ...

$ BILL_AMT2 : int 3102 1725 14027 48233 5670 57069 412023 380 14096 0 ...

$ BILL_AMT3 : int 689 2682 13559 49291 35835 57608 445007 601 12108 0 ...

$ BILL_AMT4 : int 0 3272 14331 28314 20940 19394 542653 221 12211 0 ...

$ BILL_AMT5 : int 0 3455 14948 28959 19146 19619 483003 -159 11793 13007 ...

$ BILL_AMT6 : int 0 3261 15549 29547 19131 20024 473944 567 3719 13912 ...

$ PAY_AMT1 : int 0 0 1518 2000 2000 2500 55000 380 3329 0 ...

$ PAY_AMT2 : int 689 1000 1500 2019 36681 1815 40000 601 0 0 ...

$ PAY_AMT3 : int 0 1000 1000 1200 10000 657 38000 0 432 0 ...

$ PAY_AMT4 : int 0 1000 1000 1100 9000 1000 20239 581 1000 13007 ...

$ PAY_AMT5 : int 0 0 1000 1069 689 1000 13750 1687 1000 1122 ...

$ PAY_AMT6 : int 0 2000 5000 1000 679 800 13770 1542 1000 0 ...

$ default payment next month: int 1 1 0 0 0 0 0 0 0 0 ...

- attr(*, ".internal.selfref")=<externalptr>

LIMIT_BAL SEX EDUCATION MARRIAGE AGE PAY_0 PAY_2 PAY_3 PAY_4 PAY_5 PAY_6 BILL_AMT1 BILL_AMT2

1: 20000 2 2 1 24 2 2 -1 -1 -2 -2 3913 3102

2: 120000 2 2 2 26 -1 2 0 0 0 2 2682 1725

3: 90000 2 2 2 34 0 0 0 0 0 0 29239 14027

4: 50000 2 2 1 37 0 0 0 0 0 0 46990 48233

5: 50000 1 2 1 57 -1 0 -1 0 0 0 8617 5670

6: 50000 1 1 2 37 0 0 0 0 0 0 64400 57069

BILL_AMT3 BILL_AMT4 BILL_AMT5 BILL_AMT6 PAY_AMT1 PAY_AMT2 PAY_AMT3 PAY_AMT4 PAY_AMT5 PAY_AMT6

1: 689 0 0 0 0 689 0 0 0 0

2: 2682 3272 3455 3261 0 1000 1000 1000 0 2000

3: 13559 14331 14948 15549 1518 1500 1000 1000 1000 5000

4: 49291 28314 28959 29547 2000 2019 1200 1100 1069 1000

5: 35835 20940 19146 19131 2000 36681 10000 9000 689 679

6: 57608 19394 19619 20024 2500 1815 657 1000 1000 800

default payment next month

1: 1

2: 1

3: 0

4: 0

5: 0

6: 0

The column ‘id’ has no role to play in our analysis. Hence, it is omitted.

## Droping the unnecessary variable/column

credit=credit[,-1]#There's no use of the column id in our analysis

Let’s inspect for missing values. We rename of the PAY_0 and default payment next month column.

##Looking for missing value

sum(is.na(credit))#it is observed that there's no missing values

##Changing the name of the variable PAY_0 to PAY_1

names(credit)

names(credit)[6]="PAY_1"

names(credit)[24] = "target"

Transforming all the qualitative variables into factor variables in R as per the data description.

##Transforming the variables SEX,MARRIAGE,EDUCATION and default payment into factors

df=as.data.frame(credit)

df[c("SEX","MARRIAGE","EDUCATION","target","PAY_1","PAY_2","PAY_3","PAY_4","PAY_5","PAY_6")]=

lapply(df[c("SEX","MARRIAGE","EDUCATION","target","PAY_1","PAY_2","PAY_3","PAY_4","PAY_5","PAY_6")]

,function(x) as.factor(x))

credit=df

rm(df)

The overall summary of the variables, quantitative as well as qualitative.

##Extended data dictionary

summary(credit)

LIMIT_BAL SEX EDUCATION MARRIAGE AGE PAY_1 PAY_2

Min. : 10000 1:11888 0: 14 0: 54 Min. :21.00 0 :14737 0 :15730

1st Qu.: 50000 2:18112 1:10585 1:13659 1st Qu.:28.00 -1 : 5686 -1 : 6050

Median : 140000 2:14030 2:15964 Median :34.00 1 : 3688 2 : 3927

Mean : 167484 3: 4917 3: 323 Mean :35.49 -2 : 2759 -2 : 3782

3rd Qu.: 240000 4: 123 3rd Qu.:41.00 2 : 2667 3 : 326

Max. :1000000 5: 280 Max. :79.00 3 : 322 4 : 99

6: 51 (Other): 141 (Other): 86

PAY_3 PAY_4 PAY_5 PAY_6 BILL_AMT1 BILL_AMT2

0 :15764 0 :16455 0 :16947 0 :16286 Min. :-165580 Min. :-69777

-1 : 5938 -1 : 5687 -1 : 5539 -1 : 5740 1st Qu.: 3559 1st Qu.: 2985

-2 : 4085 -2 : 4348 -2 : 4546 -2 : 4895 Median : 22382 Median : 21200

2 : 3819 2 : 3159 2 : 2626 2 : 2766 Mean : 51223 Mean : 49179

3 : 240 3 : 180 3 : 178 3 : 184 3rd Qu.: 67091 3rd Qu.: 64006

4 : 76 4 : 69 4 : 84 4 : 49 Max. : 964511 Max. :983931

(Other): 78 (Other): 102 (Other): 80 (Other): 80

BILL_AMT3 BILL_AMT4 BILL_AMT5 BILL_AMT6 PAY_AMT1

Min. :-157264 Min. :-170000 Min. :-81334 Min. :-339603 Min. : 0

1st Qu.: 2666 1st Qu.: 2327 1st Qu.: 1763 1st Qu.: 1256 1st Qu.: 1000

Median : 20089 Median : 19052 Median : 18105 Median : 17071 Median : 2100

Mean : 47013 Mean : 43263 Mean : 40311 Mean : 38872 Mean : 5664

3rd Qu.: 60165 3rd Qu.: 54506 3rd Qu.: 50191 3rd Qu.: 49198 3rd Qu.: 5006

Max. :1664089 Max. : 891586 Max. :927171 Max. : 961664 Max. :873552

PAY_AMT2 PAY_AMT3 PAY_AMT4 PAY_AMT5 PAY_AMT6

Min. : 0 Min. : 0 Min. : 0 Min. : 0.0 Min. : 0.0

1st Qu.: 833 1st Qu.: 390 1st Qu.: 296 1st Qu.: 252.5 1st Qu.: 117.8

Median : 2009 Median : 1800 Median : 1500 Median : 1500.0 Median : 1500.0

Mean : 5921 Mean : 5226 Mean : 4826 Mean : 4799.4 Mean : 5215.5

3rd Qu.: 5000 3rd Qu.: 4505 3rd Qu.: 4013 3rd Qu.: 4031.5 3rd Qu.: 4000.0

Max. :1684259 Max. :896040 Max. :621000 Max. :426529.0 Max. :528666.0

target

0:23364

1: 6636

Bivariate analysis

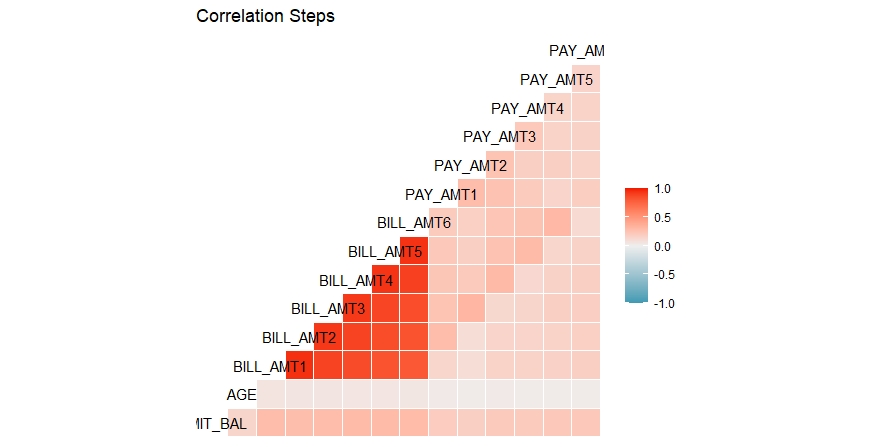

Now we’ll scrutinize the correlations between the quantitative variables and will check if there are high correlation between some of the features. We employ correlation step plot.

##Correlation analysis and Correlogram plot

df=as.data.frame(data.matrix(credit[,c(-2:-4,-6:-11,-24)]))

ggcorr(df,method=c("everything", "pearson"))+ggtitle("Correlation Steps")

rm(df)

It can be observed that the correlation among the bill amounts for 6 months are on the higher side. All other features have low or moderate correlation among them.

Visualizations

We’ll now dive into the visualizations of the dataset in hand. Several plots like density plot for credit amount , histogram of age, several bar-plots for marital status and gender also dot-plots for Credit Amount versus Payment Statuses( PAY_1 ,..,PAY_6) and Bill Amounts (BILL_AMT1 ,….,BILL_AMT6).

## Visualizing the data

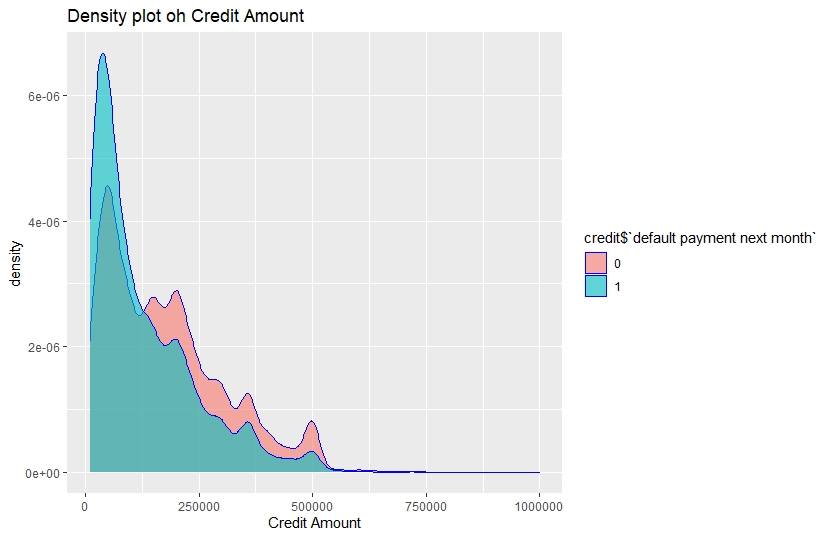

ggplot(credit,aes(x=credit$LIMIT_BAL,fill=credit$target))+

geom_density(alpha=0.6,show.legend = T,color="blue")+

ggtitle("Density plot oh Credit Amount")+

xlab("Credit Amount")

We see Customers with relatively lower credit amount tend to be the defaulters.

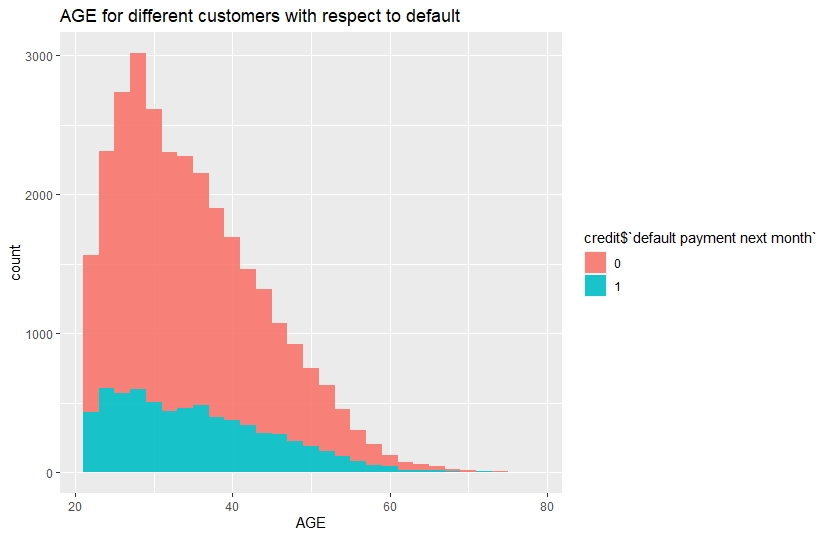

ggplot(credit,aes(x=credit$AGE,fill=credit$target))+

geom_histogram(show.legend = T,alpha=0.9)+

ggtitle("AGE for different customers with respect to default")+

xlab("AGE")

Customers with age between 20-35 have relatively higher number of defaults.

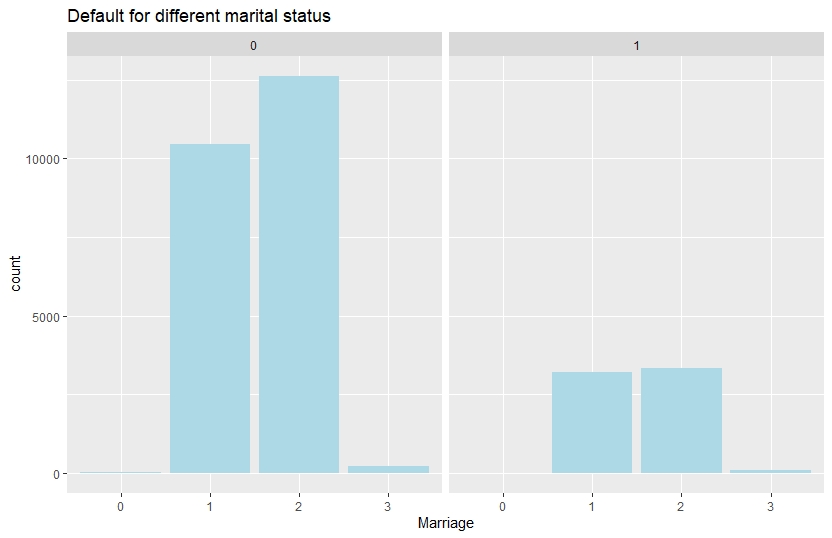

ggplot(credit,aes(x=credit$MARRIAGE,group=credit$target))+

geom_bar(show.legend = T,fill="lightblue")+

ggtitle("Default for different marital status")+

xlab("Marriage")+

facet_grid(~credit$target)

Number of default is slightly higher for single customers.

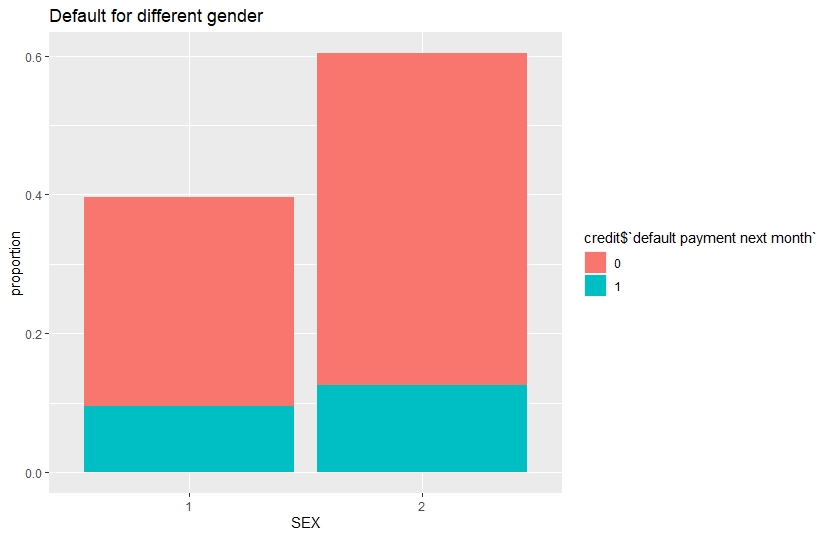

ggplot(credit,aes(x=credit$SEX,fill=credit$target))+

geom_bar(aes(y=(..count..)/sum(..count..)), show.legend = T)+

ggtitle("Default for different gender")+

xlab("SEX")+

ylab("proportion")

Proportion of default is greater for female compared to male. Now, we arrange the scatter plots of Limit Balance & Bill Amounts in a grid, colour coded in default payment status.

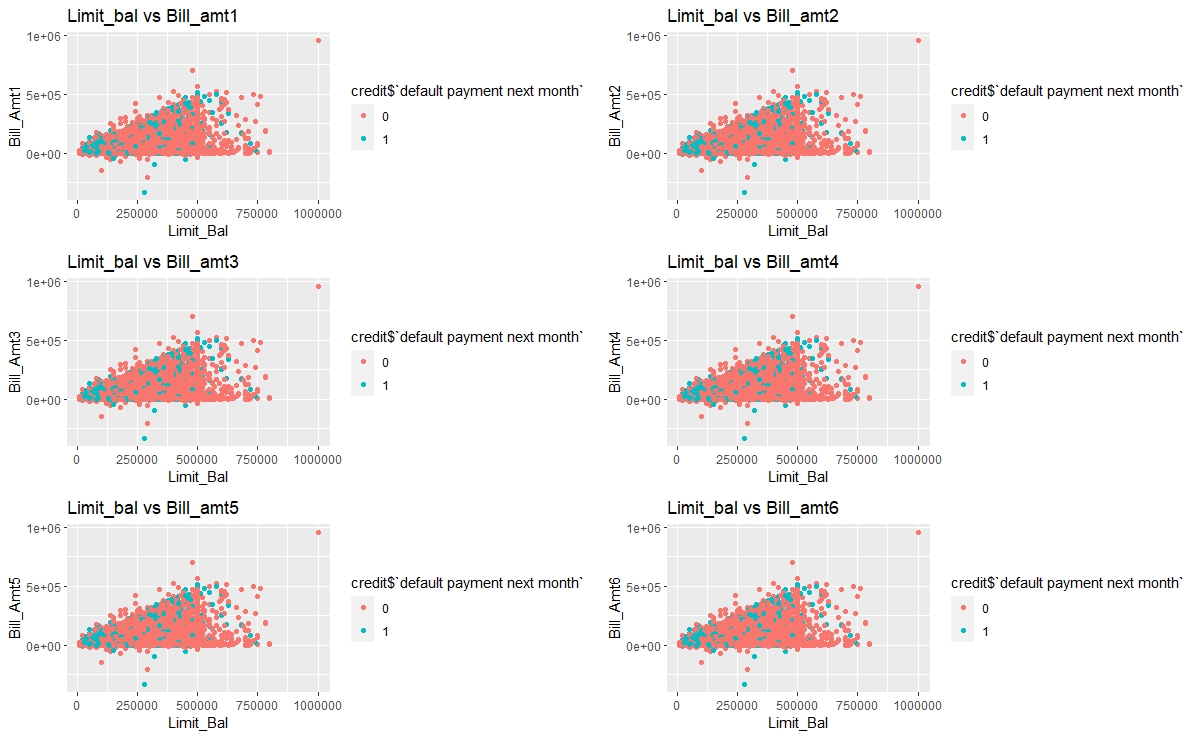

p=list() #creating empty plot list

for(i in 12:17){

p[[i]]= ggplot(credit,aes(x=credit[,1],y=credit[,i],color=credit$target))+

geom_point(show.legend = T)+

xlab("Limit_Bal")+

ylab(paste0("Bill_Amt",i-11,sep=""))+

ggtitle(paste0("Limit_bal vs Bill_amt",i-11,sep=""))

}

plot_grid(p[[12]],p[[13]],p[[14]],p[[15]],p[[16]],p[[17]],nrow=3,ncol=2)

There’s a cluster of default customers in the lower range of Limit Balalace and Bill amounts.

We make another grid of scatter plots of Repayment Statuses with Limit Balance, colour coded in default payment status.

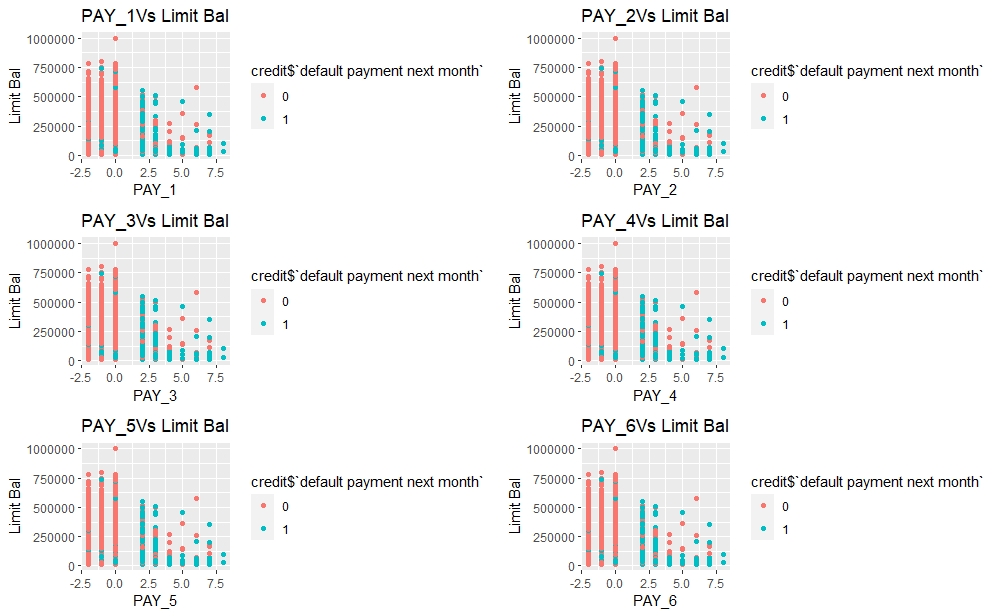

q=list() #creating empty plot list

for(i in 6:11){

q[[i]]=ggplot(credit,aes(x=credit[,i],y=credit[,1],color=credit$target,palette="jco"))+

geom_point(show.legend = T)+

xlab(paste0("PAY_",i-5,sep=""))+

ylab("Limit Bal")+

ggtitle(paste0("PAY_",i-5,"Vs Limit Bal",sep=""))

}

plot_grid(q[[6]],q[[7]],q[[8]],q[[9]],q[[10]],q[[11]],nrow=3,ncol=2)

Most of the default customers have delays in their repayment status.

Observations

The density of credit amount is high in the range 0 to 250000 for the clients with default of payment. Therefore, clients with relatively lower credit are more likely to be default. Similarly, from the histogram of age it is clear that most of the default clients are in the age bracket 20 to 40.

The proportions of females are greater than that of males for default and non- default clients. In case of defaults the no of married clients and single clients are almost same but in case of non-default clients, unmarried clients comprehensively outnumber the married ones.

The dot-plots of credit amount versus repayment statuses indicates that those who are allowed high amount of credit are able to clear their bills duly and clients with low credit amounts are the majority in defaults, which is expected. There is a kind of barrier at 500000 for credit amount and most of the clients are have allowed credit within the range 0 to 500000.

Clients with positive repayment statuses are majority of defaults which is also a very obvious fact.

Feature engineering

There are some undocumented labels in the factor variables like EDUCATION and MARRIAGE. For example, the labels 4, 5 and 6 of EDUCATION are not documented clearly in the description of the dataset, so we merge these labels with the label 0 that implies qualification other than high school, graduate and university.

Similarly, we merge the labels 0 and 3 for MARRIAGE factor.As 3 implies divorce and 0 is other. These changes are appearing reasonable to me due to the updates in the definition of the variables in the discussion zone for this dataset in Kaggle by ezboral.

Redefining the variables Education,Marriage according to the revised description of the dataset.

## Feature Engineering

credit$EDUCATION = recode_factor(credit$EDUCATION, '4' = "0", '5' = "0", '6' = "0",.default = levels(credit$EDUCATION))

credit$MARRIAGE = recode_factor(credit$MARRIAGE, '0'="3",.default = levels(credit$MARRIAGE))

Of course there are scopes to go deeper into engineering more features like variable transformations, important variables selection etc. However, these are good when working with one or two models based on their criteria for good fit, but in study of a good no of models too much upgradation in features may lead to misleading results and a loss of interpretability. Therefore, we won’t indulge in any further engineering.

Data pre-processing

We divide the whole data into two parts, quantitative and qualitative for future reference and one hot encoding (dummy encoding).

##Partitioning the whole data in quantitative and qualitative parts and defining the target

quanti=credit[,c(-2:-4,-6:-11,-24)]

quali=credit[,c(2:4,6:11)]

target=credit$target

(table(target)/length(target))

Then combine all the features quantitative and qualitative into one single data-frame.

all.features=cbind(quanti,quali,target)

head(all.features)

LIMIT_BAL AGE BILL_AMT1 BILL_AMT2 BILL_AMT3 BILL_AMT4 BILL_AMT5 BILL_AMT6 PAY_AMT1 PAY_AMT2 PAY_AMT3 PAY_AMT4

1: 20000 24 3913 3102 689 0 0 0 0 689 0 0

2: 120000 26 2682 1725 2682 3272 3455 3261 0 1000 1000 1000

3: 90000 34 29239 14027 13559 14331 14948 15549 1518 1500 1000 1000

4: 50000 37 46990 48233 49291 28314 28959 29547 2000 2019 1200 1100

5: 50000 57 8617 5670 35835 20940 19146 19131 2000 36681 10000 9000

6: 50000 37 64400 57069 57608 19394 19619 20024 2500 1815 657 1000

PAY_AMT5 PAY_AMT6 SEX EDUCATION MARRIAGE PAY_1 PAY_2 PAY_3 PAY_4 PAY_5 PAY_6 target

1: 0 0 2 2 1 2 2 -1 -1 -2 -2 1

2: 0 2000 2 2 2 -1 2 0 0 0 2 1

3: 1000 5000 2 2 2 0 0 0 0 0 0 0

4: 1069 1000 2 2 1 0 0 0 0 0 0 0

5: 689 679 1 2 1 -1 0 -1 0 0 0 0

6: 1000 800 1 1 2 0 0 0 0 0 0 0

We will define a few empty numeric variables, which will be used for comparison of the models.

err1=numeric()

err2=numeric() #Creating empty vectors for further comparisons

auc1=numeric()

auc2=numeric()

Test-Train split of the data

We split the combined data-frame(or data-table) into two parts. One is training set, consists of 80% of the data, on which the model(s) will be trained and the other one is test set, consists of remaining 20% of the data, on which the model(s) will be validated.

#Splitting the into test and train sets in 80:20 ratio

set.seed(666)#for reproducability of result

ind=sample(nrow(all.features),24000,replace = F)

train.logit=all.features[ind,]

test.logit=all.features[-ind,]

Model fitting

For each of the six models we’ll perform the task according to the following template:

- Training the model on the training set(tuning the hyper-parameters if needed)

- Making prediction on both train and test set

- Calculate error rate for both the sets and store them in two vector

- Plotting ROC curve for both the sets and store the area under curve(AUC) in two vectors

- Lastly plot a cumulative gain chart for test set. For detailed codes of Cummulative Gain chart visit here.

Logistic Regression

Logistic regression is a binary classification algorithm used to model the probability of an individual belonging to a class. Generally a binary response variable with two category (in our case default payment) denoted by ‘0’ and ‘1’ is regressed by logistic regression. In logistic model, the log of odds of the binary response to be ‘1’ is predicted by a linear regression equation that can include continuous as well as factor variables. However, the factor variables are needed to be encoded as one indicator variable for each label. The corresponding predicted probability of the value labeled as ‘1’ is converted to the class ‘1’ or ‘0’ by using threshold value.

Fitting a logistic model

model.logit=glm(target~.,data=train.logit,family="binomial")

summary(model.logit)

Making prediction for the train set and test set

pred.logit=predict(model.logit,type="response",newdata = test.logit)

pred.def=ifelse(pred.logit>0.5,"1","0")

pred.def=ifelse(predict(model.logit,type="response",newdata = train.logit)>0.5,"1","0")

Calculate error rate for both train and test set

conf1=table(predict=pred.def,true=test.logit$target)

conf1.train=table(predict=pred.def,true=train.logit$target)

err2[1]= 1 - sum(diag(conf1))/sum(conf1)

err1[1]= 1 - sum(diag(conf1.train))/sum(conf1.train)

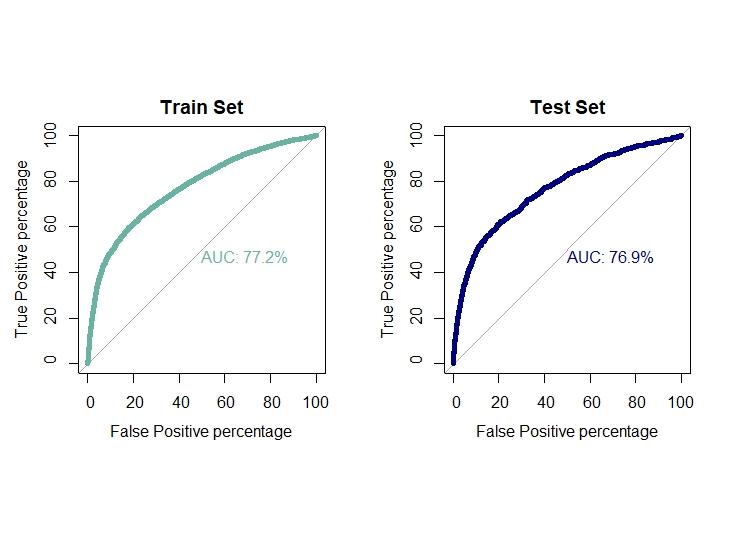

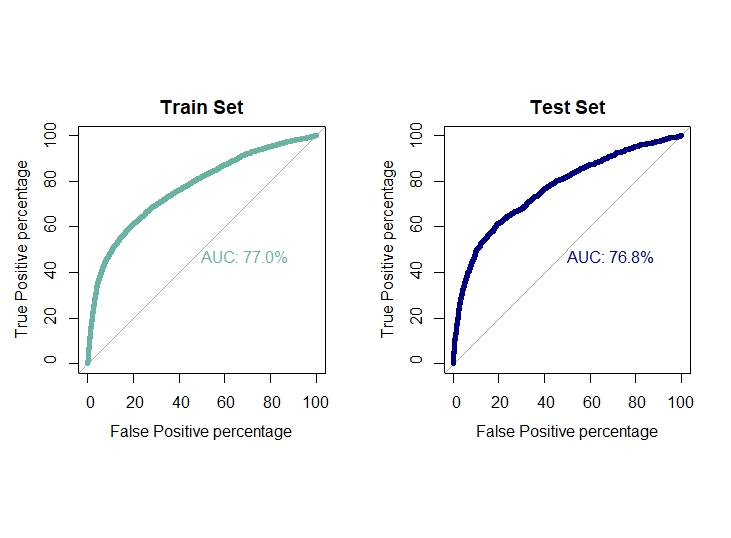

Ploting ROC curve and AUC for test and train set

par(mfrow=c(1,2))

par(pty="s")

For training set

roc(train.logit$target,model.logit$fitted.values,plot=T,col="#69b3a2",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Train Set")

For test set

roc(test.logit$target,pred.logit,plot=T,col="navyblue",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Test Set")

auc1[1]=0.772

auc2[1]=0.769

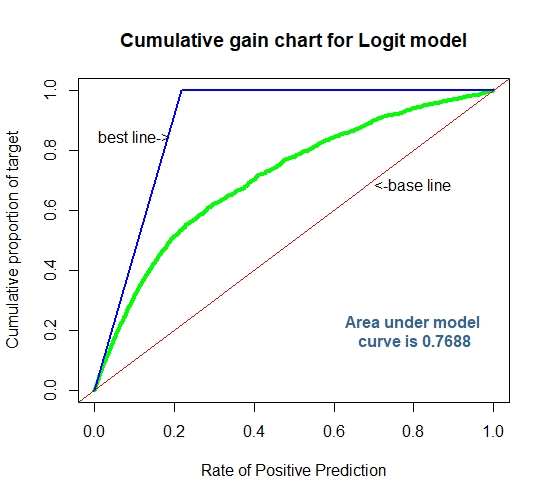

Cummulative Gain Chart for The Logit Model

Linear Discriminant Analysis

Linear discriminant analysis is a generalized version of Fisher’s discriminant rule. This method is also used in machine learning for classification problem. This model specifies that for each given class of response variable the posterior probability of a sample given the class follows multivariate normal distribution with common variance-covariance matrix. LDA also use linear combination of features for discriminating the different categories of the response variable and its objective is to maximize the distance between different categories and minimizing the distance within each category. Besides the formula and training data, one more parameter prior is passed to the function lda(). prior is a vector specifying the prior probabilities of class membership. We will use the proportion of the classes in our dataset as our input.

Fitting a Linear discriminent model

model.lda=lda(target~.,data=train.logit,prior=c(0.7788,0.2212))

model.lda

Making prediction for both test set and test set

pred.lda=predict(model.lda,test.logit)

data.frame(pred.lda$posterior)

pred.lda.prob=pred.lda$posterior[,2]

pred.lda.train=predict(model.lda,train.logit)

data.frame(pred.lda.train$posterior)

Calculate the error rate for both test and train set

conf2=table(predict=pred.lda$class,true=test.logit$target)

err2[2]= 1 - sum(diag(conf2))/sum(conf2)

conf2.train=table(predict=pred.lda.train$class,true=train.logit$target)

err1[2]= 1 - sum(diag(conf2.train))/sum(conf2.train)

Ploting ROC curve and AUC for test and train set

par(mfrow=c(1,2))

par(pty="s")

roc(train.logit$target,pred.lda.train$posterior[,2],plot=T,col="#69b3a2",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Train Set")

roc(test.logit$target,pred.lda.prob,plot=T,col="navyblue",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Test Set")

auc1[2]=0.770

auc2[2]=0.768

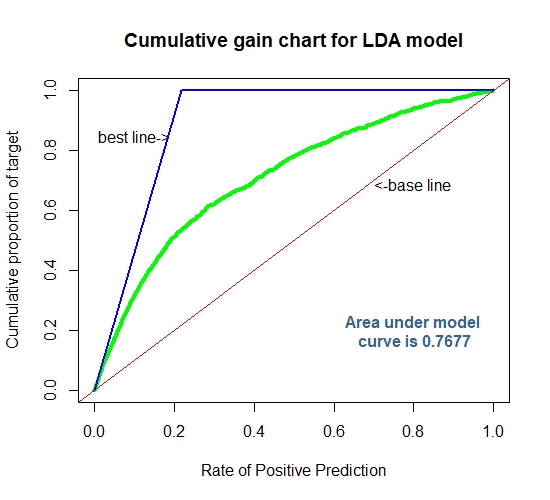

Cummulative Gain Chart for The LDA

K-Nearest Neighbor

K-nearest neighbor is a non-parametric algorithm that can be used in classification problem. For a given sample a KNN classifier search for the pattern in the neighborhood of the sample and assign the sample to the class closest to the sample. In KNN classification the output is a class membership and the output class is obtained from the majority of votes from the neighbors. Closeness of the class is defined by the distance between the sample and the neighbors. The parameter k in the classifier is an integer, defines the no of member in the neighborhood to be considered. Here k=1 implies the sample is assigned to the class of the single neighbor. We will use a for-loop to check for a range of values of k for which the model produces highest accuracy.

FItting K Nearest Neighbor classifier

Preprocessing the data #min-max normalization of quantitative features

f=function(x)

{

return((x-min(x))/(max(x)-min(x)))

}

quanti.norm=quanti

setDF(quanti.norm)#Converting into data.frame

for(i in 1:14){

quanti.norm[,i]=f(quanti.norm[,i]) #Normalization

}

Dummy encoding for factor variables

quali.dummy=dummy.data.frame(quali)

Merging the normalized data and encoded dummies

target=recode_factor(target,'0'="no",'1'="yes")

data.knn=cbind(quanti.norm,quali.dummy,target)

setDT(data.knn)#Converting into data.table

Split the Test & train set in 80:20 ratio

set.seed(666) #For Reproducibility

ind=sample(nrow(data.knn),nrow(data.knn)*0.8,replace = F)

train.knn=data.knn[ind,]

test.knn=data.knn[-ind,]

trainy=train.knn$target

model.list=list()#empty list

v=numeric()

set.seed(222)

for(i in 1:30){

model.list[[i]]=knn3(train.knn[,-88],trainy,k=i)

tab=table(prediction=predict(model.list[[i]],test.knn[,-88],type = "class"),truth=test.knn$target)

v[i]=sum(diag(tab)/sum(tab))

}

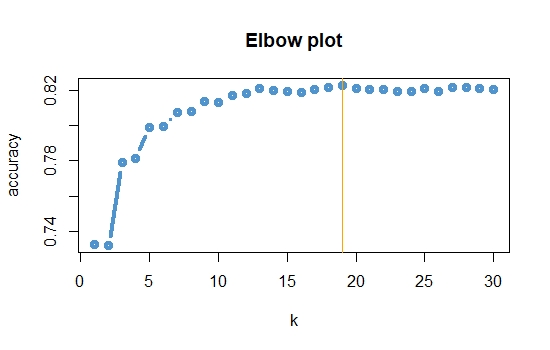

which.max(v)

plot(1:30,v,type="b",xlab="k",ylab="accuracy",main="Elbow plot",font.main=2,col="steelblue3",lwd=4)

abline(v=19,col="orange")

model.knn=knn3(train.knn[,-88],trainy,k=19)#Best model in terms of accuracy

Prediction and calculating error rate on test set

set.seed(666)

conf3=table(prediction=predict(model.knn,test.knn[,-88],type = "class"),truth=test.knn$target)

err2[3]=1 - sum(diag(conf3))/sum(conf3)

knn.prob=predict(model.knn,test.knn[,-88],type="prob")[,2] #Probalities of "yes"

Prediction and calculating error rate on Training set

set.seed(666)

conf3.train=table(prediction=predict(model.knn,train.knn[,-88],type = "class"),truth=train.knn$target)

err1[3]=1 - sum(diag(conf3.train))/sum(conf3.train)

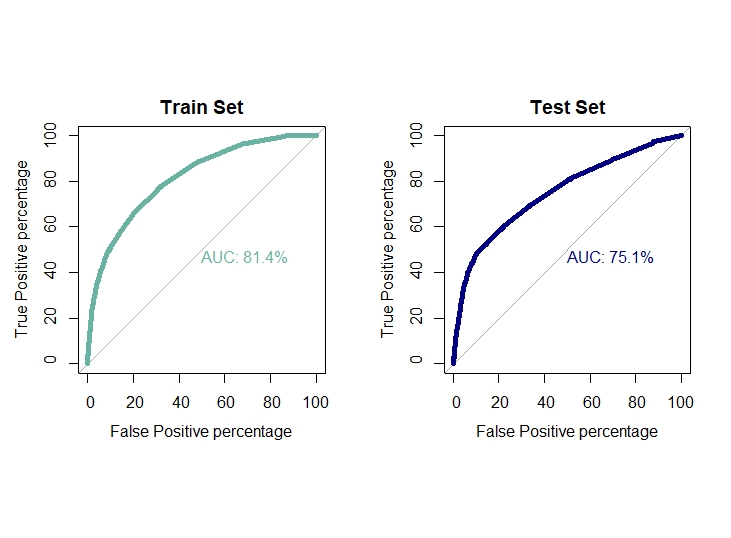

Ploting ROC curve and AUC for test and train set

par(mfrow=c(1,2))

par(pty="s")

roc(train.knn$target,predict(model.knn,train.knn[,-88],type="prob")[,2],plot=T,col="#69b3a2",print.auc=T,legacy.axes=TRUE,

percent = T,xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Train Set")

roc(test.knn$target,knn.prob,plot=T,col="navyblue",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Test Set")

auc1[3]=0.814

auc2[3]=0.751

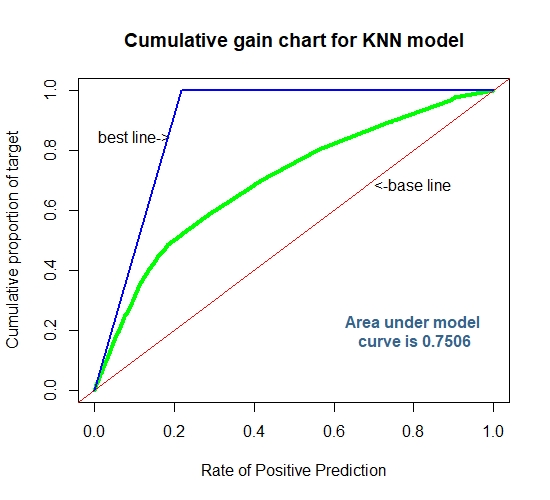

Cummulative Gain Chart for The K-NN Model

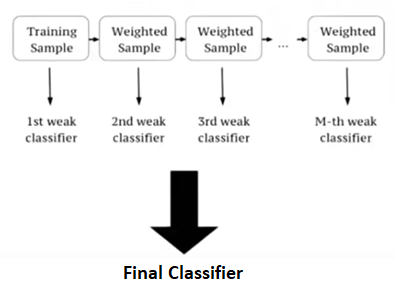

Extreme Gradient Boost

XGBoost is a supervised machine learning algorithm based on decision trees, an en that performs under gradient boosting framework. In boosting, the models are built sequentially by improving upon the errors from previous models. Gradient boosting algorithm on the other hand improve or minimize the error from previous models by employing gradient descent algorithm to give optimized weightage to the previously high performing models. Then comes XGBoost that is similar to gradient boosting but uses a more regularized model by penalizing complex models using Ridge and Lasso regularization to prevent overfitting. For structured data this algorithm performs really well for its ability of parallel computing and sequential learning.

The wide range of hyper parameters is one of the main reason of flexibility of this model. Some of those parameters that have been used in our training are discussed below:

- objective: The objective function used . Specify the learning task and the corresponding learning objective.

- booster: which booster to use, can be gbtree or gblinear.

- eta: control the learning rate: scale the contribution of each tree by a factor of 0 < eta < 1 when it is added to the current approximation. Used to prevent overfitting by making the boosting process more conservative. Lower value for eta implies larger value for nrounds: low eta value means model more robust to overfitting but slower to compute.

- nrounds: max number of boosting iterations.

- eval_metric: evaluation metrics for validation data.

- max_depth: maximum depth of a tree.

- colsample_bytree: subsample ratio of columns when constructing each tree.

- subsample: subsample ratio of the training instance. Setting it to 0.5 means that xgboost randomly collected half of the data instances to grow trees and this will prevent overfitting.

- min_child_weight: minimum sum of instance weight (hessian) needed in a child. If the tree partition step results in a leaf node with the sum of instance weight less than min_child_weight, then the building process will give up further partitioning. In linear regression mode, this simply corresponds to minimum number of instances needed to be in each node. The larger, the more conservative the algorithm will be.

- gamma: minimum loss reduction required to make a further partition on a leaf node of the tree. the larger, the more conservative the algorithm will be.

- early_stoping_rounds: the early stopping function is not triggered. If set to an integer k, training with a validation set will stop if the performance doesn’t improve for k rounds.

- label: vector of response values.

We will tune these parameters using caret package and train() function by enabling parallel computing to get the optimal values of the parameters that optimizes the chosen metric (accuracy or ROC).

FItting XGBoost classifier

set.seed(666)

library(parallel)

Calculate the number of cores

no_cores <- detectCores()-1

create the cluster for caret to use

library(doParallel)

cl <- makePSOCKcluster(no_cores)

registerDoParallel(cl)

Preprocessing the data for XGboost

target=as.numeric(recode_factor(target,'no'="0",'yes'="1"))

target=ifelse(target==1,0,1)#assiging 1 for default and 0 for non-default

data_xgb=cbind(quanti,quali.dummy,target)

Spliting the train & test in 80:20 ratio

set.seed(666) #For Reproducibility

ind=sample(nrow(data_xgb),nrow(data_xgb)*0.8,replace = F)

train_xgb=data_xgb[ind,]

test_xgb=data_xgb[-ind,]

Using caret package to tune the hyperparameters further

xgb_control=trainControl(method="cv",number = 3,allowParallel = T,

classProbs = T,summaryFunction = twoClassSummary)

xgb_grid=expand.grid(nrounds=seq(100,200,by=25),eta=c(0.08,0.09,seq(0.1,0.5,by=0.2)),max_depth=seq(2,6,by=1),gamma=c(0,0.5,1),

subsample=c(0.8,1),colsample_bytree=seq(0.8,1,by=0.1),min_child_weight=seq(1,3,by=1))

model.xgb=train(x=as.matrix(train_xgb[,-88]),y=recode_factor(as.factor(train_xgb$target),'0'="no",'1'="yes"),

method="xgbTree",

tuneGrid = xgb_grid

,trControl = xgb_control)

# model.xgb$bestTune

The final model

set.seed(666)

xgb_param=trainControl(method="none",classProbs = T,summaryFunction = twoClassSummary,allowParallel = T)

model.xgb=train(x=as.matrix(train_xgb[,-88]),y=recode_factor(as.factor(train_xgb$target),'0'="no",'1'="yes"),

method="xgbTree",verbose=T,

tuneGrid = expand.grid(eta=0.08,nrounds=125,

max_depth=6,colsample_bytree=0.9,gamma=0.5,

min_child_weight=1,subsample=0.8)

,trControl = xgb_param)

stopCluster(cl)

registerDoSEQ()

Prediction and calculating error rate for train set

p_train=predict(model.xgb,newdata = as.matrix(train_xgb[,-88]))

conf4.train = table(predict=p_train,true=train_xgb$target)

err1[4] = (conf4.train[1,2]+conf4.train[2,1])/sum(conf4.train)

p_train_prob = predict(model.xgb,newdata = as.matrix(train_xgb[,-88]),type="prob")$yes

Prediction and calculating error rate for test set

p_test=predict(model.xgb,newdata = as.matrix(test_xgb[,-88]))

conf4 = table(predict=p_test,true=test_xgb$target)

err2[4]= (conf4[1,2]+conf4[2,1])/sum(conf4)

xgb.prob=predict(model.xgb,newdata = as.matrix(test_xgb[,-88]),type="prob")$yes

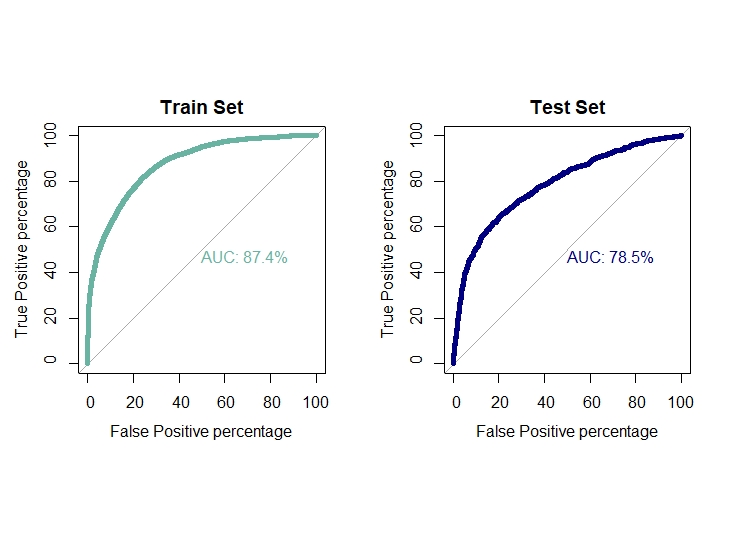

ROC plot for train and test set

par(mfrow=c(1,2))

par(pty="s")

roc(response=as.factor(train_xgb$target),predictor=p_train_prob,percent = T,plot = T,col="#69b3a2",print.auc=T,

legacy.axes=T,xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Train Set")

roc(response=as.factor(test_xgb$target),predictor=xgb.prob,percent = T,plot = T,col="navyblue",print.auc=T,

legacy.axes=T,xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Test Set")

auc1[4]=0.874

auc2[4]=0.785

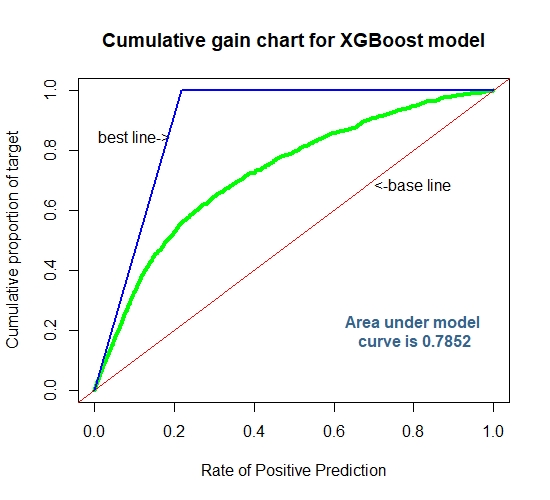

Cummulative Gain Chart for The Extreme Gradient Boosting

Kernel SVM

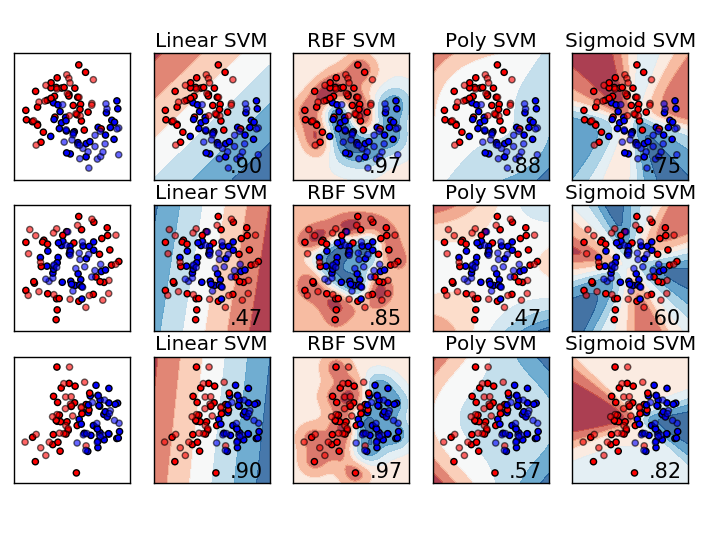

The Support Vector Machine (SVM) algorithm is a popular machine learning tool that offers solution for both classification and regression problems. Given a set of training algorithms builds a model that assigns new examples to one or the other of two categories , an SVM training algorithm builds a model that assigns new examples to one category or the other, making it a non-probabilistic binary linear classifier. SVM model is a presentation of the examples as points in space, mapped so that the examples of the separate catagories are divided by a clear margin that is as wide as possible. New examples are then mapped into that same space and predicted to belong to a category based on the side of the margin on which they fall.

In addition to performing linear classification, SVMs can efficiently perform a non-linear classification using what is called the Kernel- trick, implicitly mapping their inputs into high dimensional feature spaces. SVM algorithm use a set of mathematical function that are defined as the kernel . The function of kernel is to take data as input and transform it into the required form. Different SVM algorithms use different types of kernel functions, namely linear, non-linear, polynomial, radial basis function (RBF), sigmoid.Introduce Kernel functions for sequence data, graphs, texts, images as well as vectors. The most used type of Kernel function is RBF. Because it has localized and finite response along the entire x-axis.

SVM Hyperparameter tuning using GridSearch

A Machine Learning model is defined as a mathematical model with a number of parameters that need to be learned from the data . However, there are some parameters, known as Hyperparameters. SVM also has some hyperparameters (like what C or gamma (γ) values to use) and finding optimal hyperparameter is a very hard task to solve . The effectiveness of SVM depends on the selection of Kernel’s parameter C . A common choice is a Gaussian Kernel, which has a single parameter gamma (γ) . The best combination of C and gamma (γ) is often selected by Grid Search with exponentially growing sequences of C and ( ) . Typically, each combination of parameter choices is checked using cross-validation, and the parameters with best cross- validation accuracy are picked as the best tuned one.

Fitting Support Vector Machines

Data_for_SVM

data.svm = cbind.data.frame(quanti.norm,quali,target) # SVM accepts factor variables

data.svm = setDT(data.svm)

Splitting the data into 80:20 ratio

set.seed(666)

ind=sample(nrow(data.svm),nrow(data.svm)*0.8,replace = F)

train.svm=data.svm[ind,]

test.svm=data.svm[-ind,]

registerDoParallel(cl)

Tuning Hyperparameters for SVM

SVM_Radial_Fit = train(target~.,train.svm, method = "svmRadial",verbose = F,

trControl = trainControl(method = "cv",

number = 10,allowParallel = T))

stopCluster(cl)

registerDoSEQ()

#SVM_Radial_Fit$bestTune

Model Fitting

set.seed(666)

model.svm = svm(target ~ .,data=train.svm,cost = 1, gamma = 0.1885286,

type="C-classification",kernel="radial",

probability = T)

Prediction and calculating error rate for test set

pred.svm = predict(model.svm,newdata = test.svm[,-24],probability = T)

pred.svm.prob = as.data.frame(attr(pred.svm,"prob"))[,2]

conf5 = table(predicted = pred.svm,true = test.svm$target)

err2[5] = 1 - sum(diag(conf5))/sum(conf5)

Prediction and calculating error rate for training set

pred.svm.train=predict(model.svm,newdata = train.svm[,-24],probability=T)

conf5.train=table(predicted =predict(model.svm,newdata = train.svm[,-24],probability = T),true = train.svm$target)

err1[5] = 1 - sum(diag(conf5.train))/sum(conf5.train)

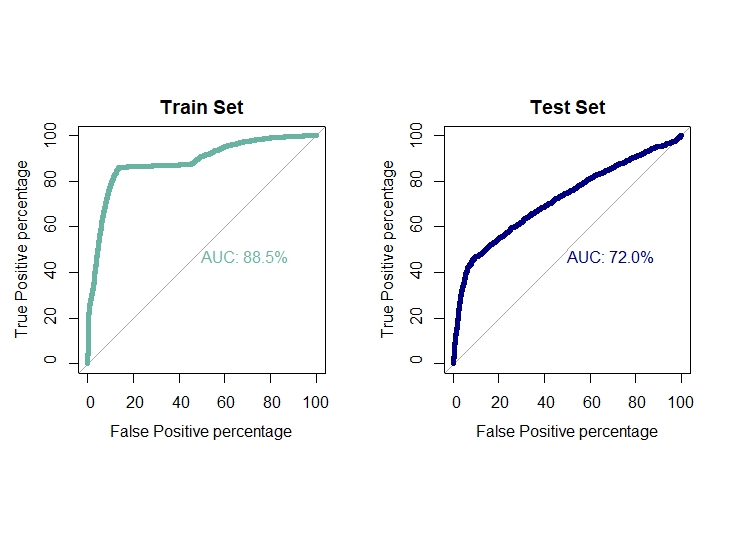

ROC curve and AUC value for both train and test set

par(mfrow=c(1,2))

par(pty="s")

roc(train.svm$target,as.data.frame(attr(predict(model.svm,newdata = train.svm[,-24],probability = T),"prob"))[,2],plot=T,

col="#69b3a2",print.auc=T,legacy.axes=TRUE,percent = T,xlab="False Positive percentage",

ylab="True Positive percentage",lwd=5,main="Train Set")

roc(test.svm$target,pred.svm.prob,plot=T,col="navyblue",print.auc=T,legacy.axes=TRUE,percent = T,

xlab="False Positive percentage",ylab="True Positive percentage",lwd=5,main="Test Set")

auc1[5] = 0.885

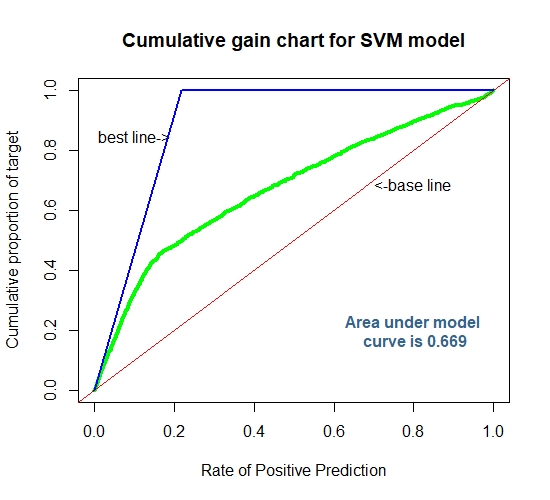

auc2[5] = 0.670

Cummulative Gain Chart for The SVM

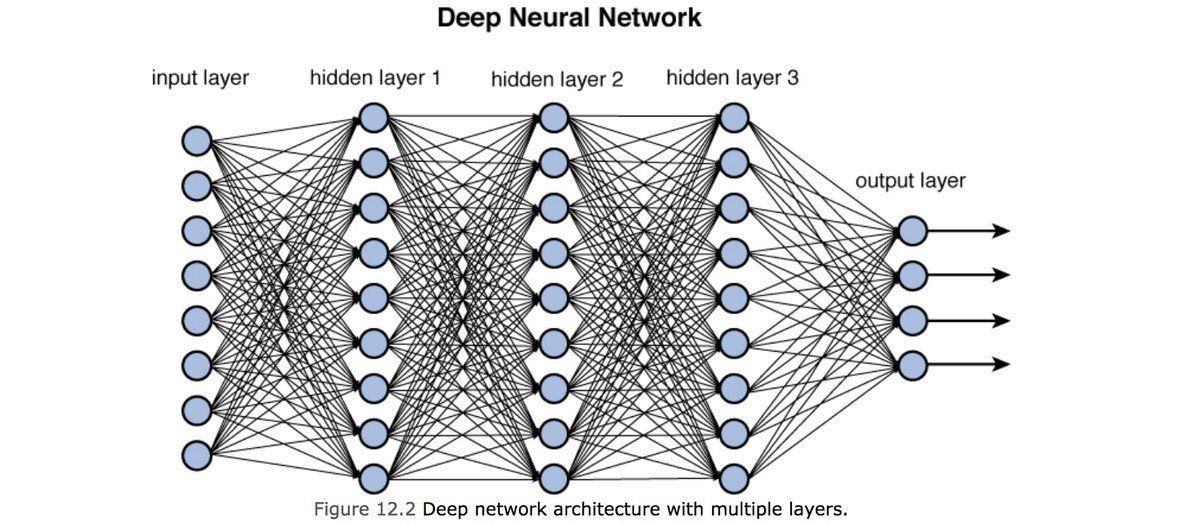

ARTIFICIAL NEURAL NETWORK (ANNs)

Artificial Neural Networks (ANNs) is a computational model based on the structure and functions of biological neural network . Information that flows through the network affects the structure of the ANN because a neural network changes or learns , in a sense - based on that input and output . ANNs are considered non-linear statistical data modeling tools where the complex relationships between inputs and outputs are modeled or pattern are found

COMPONENTS OF ANNs

- Neurons

ANNs are composed of artificial neural networks which are conceptually derived from biological neurons. Each artificial neural network has inputs and produce output which can be sent to multiple neurons .

- Connections and Weights

The network consists of connections , each connection providing the output of one neuron as an input to another neuron .To find the output of the neuron , first we take the weighted sum of all the inputs , weighted by the weights of the connections from the inputs to the neurons . The weighted sum then passed through a (usually non-linear) activation function to produce the output .

- Propagation Function

The propagation function computes the input to a neuron from the outputs of itd predecessor neurons and their connections as a weighted sum.

- Hyperparameter

A hyperparameter is a constant parameter whose value is a set before the learning process begins . The values of the parameters are derived via learning .Examples of the hyperparameter includes learning rate , the number of hidden layers and the batch size . Hyperparameter Optimization is a big part of deep learning . The reason is that neural networks are notoriously difficult to configure and there are a lot of parameters that we need to set . on the top of that , individual models can be very slow to train. That is why we use the grid search capability to tune the hyperparameters for the model.

Artifical Neural Network Classifier

data.ann =cbind(quanti.norm, quali.dummy, target)

setDF(data.ann) #Converting into data.table

Spliting the train & test set in 80:20 ratio

set.seed(666) #For Reproducibility

ind=sample(nrow(data.ann),nrow(data.ann)*0.8,replace = F)

train.ann=data.ann[ind,]

test.ann=data.ann[-ind,]

registerDoParallel(cl)

Tuning Hyperparameters for ANN

set.seed(666)

param = trainControl(method = "cv",number = 5 , allowParallel = T,classProbs = T,summaryFunction = twoClassSummary,search = "grid")

ann.fit = train(recode_factor( target,'0'="no",'1'="yes")~., train.ann,

method = "nnet",

trControl = param,

metric = "ROC",

trace = FALSE,

maxit = 200)

Stop parallel Computation

stopCluster(cl)

registerDoSEQ()

#getModelInfo()$nnet

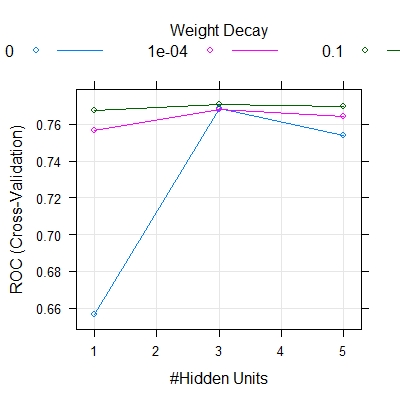

ann.fit$bestTune

[1] size decay

3 0.1

plot(ann.fit)

Model Fitting based on the Grid Search

set.seed(666)

model.ann = nnet(target~., data = train.ann, size =3, decay = 0.1,maxit=200)

Prediction and calculating error rate for Test Set

pred.ann.prob = predict(model.ann, newdata= test.ann[,-88])

pred.ann = ifelse(pred.ann.prob > 0.5, "1", "0" )

conf6 = table(predict= pred.ann , true = test.ann$target)

err2[6] = (conf6[1,2]+conf6[2,1])/sum(conf6)

Prediction and calculating error rate for Training Set

pred.ann.train.prob = predict(model.ann , newdata = train.ann[,-88])

pred.ann.train = ifelse(pred.ann.train.prob > 0.5, "1", "0" )

conf6.train = table(predicted = pred.ann.train, true = train.ann$target)

err1[6] = 1-sum(diag(conf6.train))/sum(conf6.train)

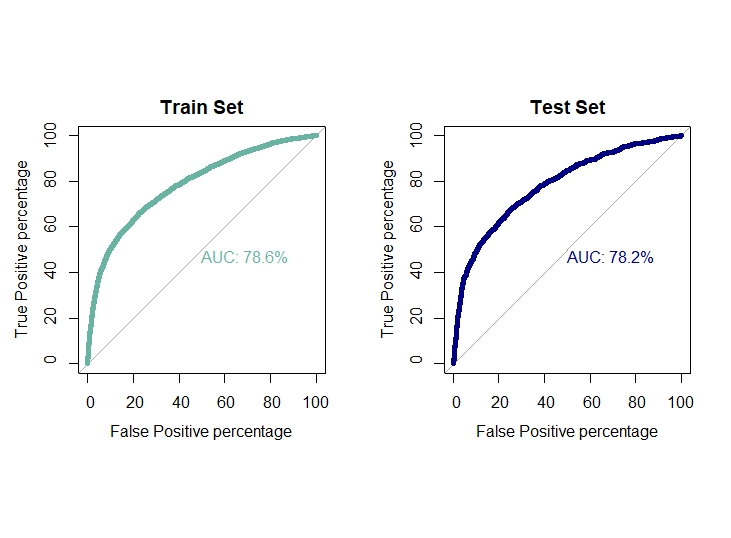

ROC curve and AUC value

par(mfrow=c(1,2))

par(pty="s")

roc(train.ann$target , pred.ann.train.prob , plot = T,col = "#69b3a2", print.auc = T, legacy.axes = TRUE , percent = T,

xlab = "False Positive percentage", ylab = "True Positive percentage",lwd = 5, main = "Train Set")

roc(test.ann$target , pred.ann.prob , plot = T,col = "navyblue", print.auc = T, legacy.axes = TRUE , percent = T,

xlab = "False Positive percentage", ylab = "True Positive percentage",lwd = 5, main = "Test Set")

auc1[6] = auc(train.ann$target , pred.ann.train.prob)

auc2[6] = auc(test.ann$target , pred.ann.prob)

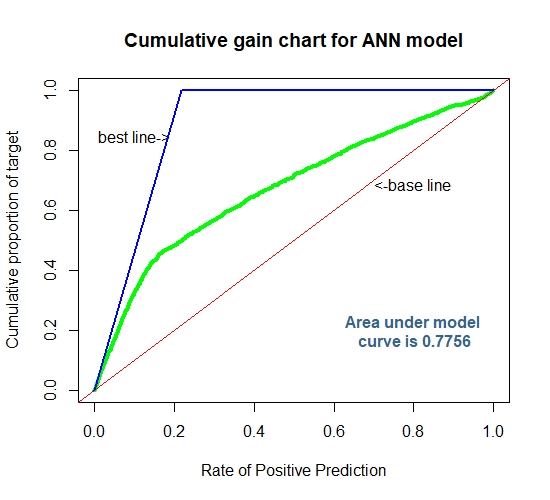

Cummulative Gain Chart for ANN

For a more detailed code on Cumulative Gain Charts visit here.

Evaluation of Classification Performances

To evaluate the classification performances of the six aforementioned models we employed the following measures:

- Error rate for training set

- Error rate for test/validation set

- Area under ROC for training set

- Area under ROC for test set

Classification Evaluation for the above six models

classification.eval=data.frame(Model=c("Logistic","LDA","KNN","XGBoost","SVM","ANN"),Train.Error=err1,

Validation.Error=err2, Train.AUC=auc1, Validation.AUC=auc2)

classification.eval

Model Train.Error Validation.Error Train.AUC Validation.AUC

1 Logistic 0.1778750 0.1800000 0.7720000 0.7690000

2 LDA 0.1785417 0.1783333 0.7700000 0.7680000

3 KNN 0.1767083 0.1767083 0.8140000 0.7510000

4 XGBoost 0.1521250 0.1683333 0.8740000 0.7850000

5 SVM 0.1606250 0.1721667 0.8850000 0.6700000

6 ANN 0.1765000 0.1716667 0.7792848 0.7755674

From the above table, it can be observed that the model XGBoost has minimum error rate for test and train set and maximum AUC for train and test set. Hence, XGBoost classifier has definitely performed best among the six models as far as classification is concerned.

Sorting Smoothing Method

Earlier we have compared the six models based on the measures like error rate and AUC. And observed that XGBoost has performed better than the other five models in terms of least error rate and maximum AUC. However, in risk management study the confidence of a model on an individual sample to belong to the class predicted by the model is of far more significance rather than just binary classification results like, ‘default’ or ‘non-default’. By the term ‘confidence’, we mean the accuracy of predicted probability of default.

Since the real probability of default is unknown, the ‘Sorting Smoothing Method’, SSM is employed here to estimate the real probability of default. Firstly, according to the predictive probability from a model we sort the validation or test set in ascending order. Then SSM is used to estimate real probability as follows:

Pi = (Yi-n+……+Yi-1+Yi+Yi+1 +…..+ Yi+n )/(2n+1)

Pi=Estimated real probability of default for ith ordered sample in test set

Yi = ith order value of the binary response variable

And, n= number of data for smoothing. Here we’ll use n=50.

Now treating this estimated real probability of default as real we plot a scatter plot diagram, with predicted probability from model along the X axis and the estimated real probability along the Y axis. Then we fit a linear regression line Y=A+Bx, from the scatter plot. Lastly, the model for which A is closest to 0, B is closest to 1 and R² is highest, is considered as the best model to represent the real probability of default.

To see the detailed code for the sorting-smoothing method visit here.

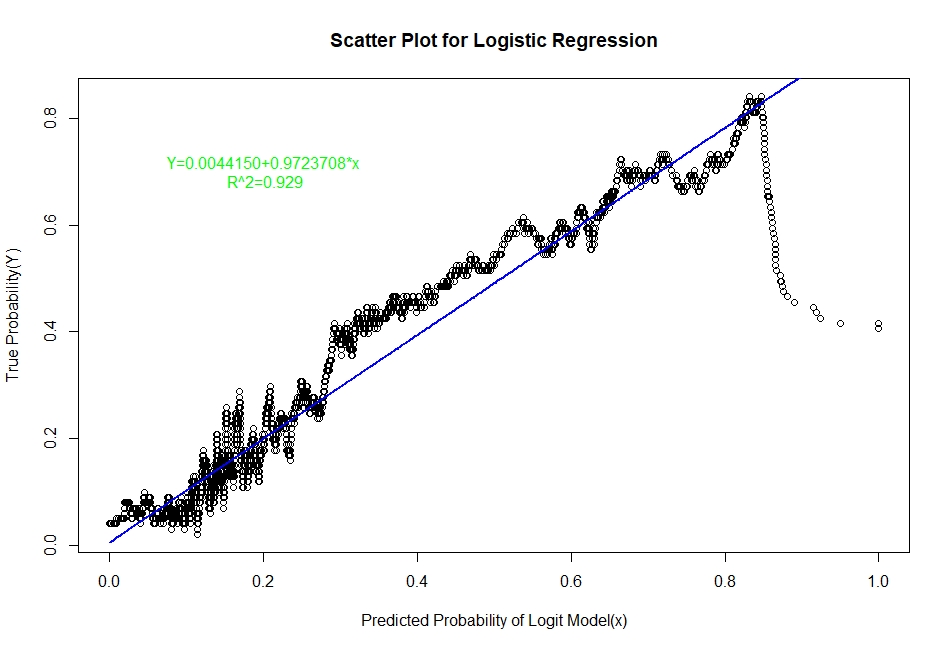

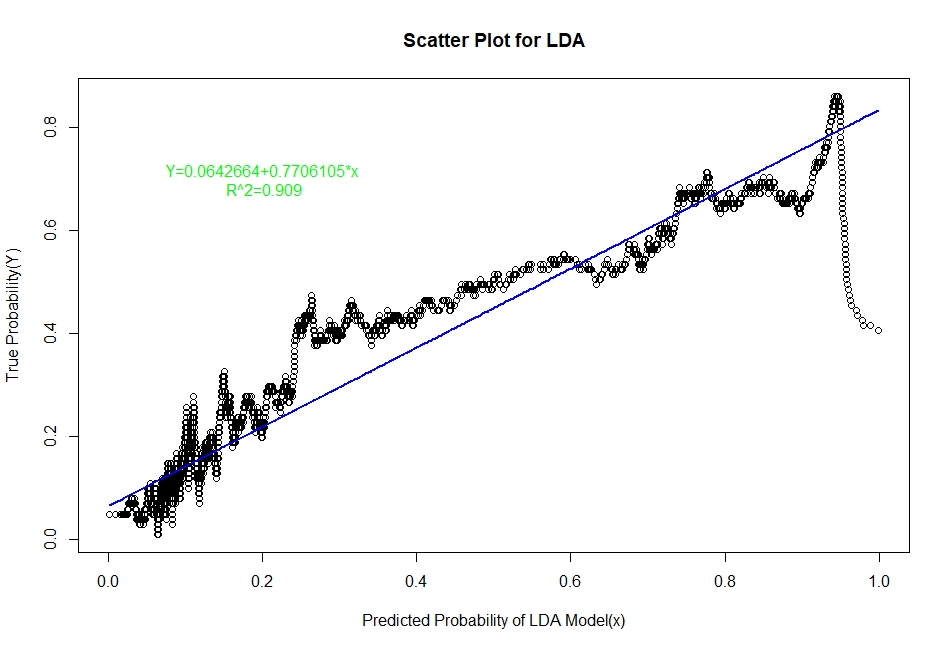

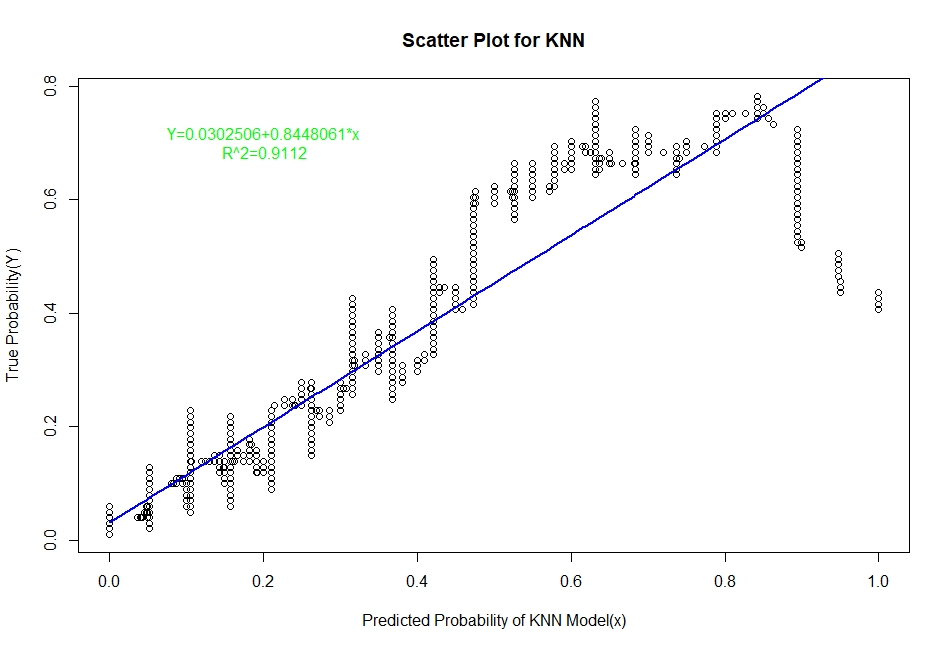

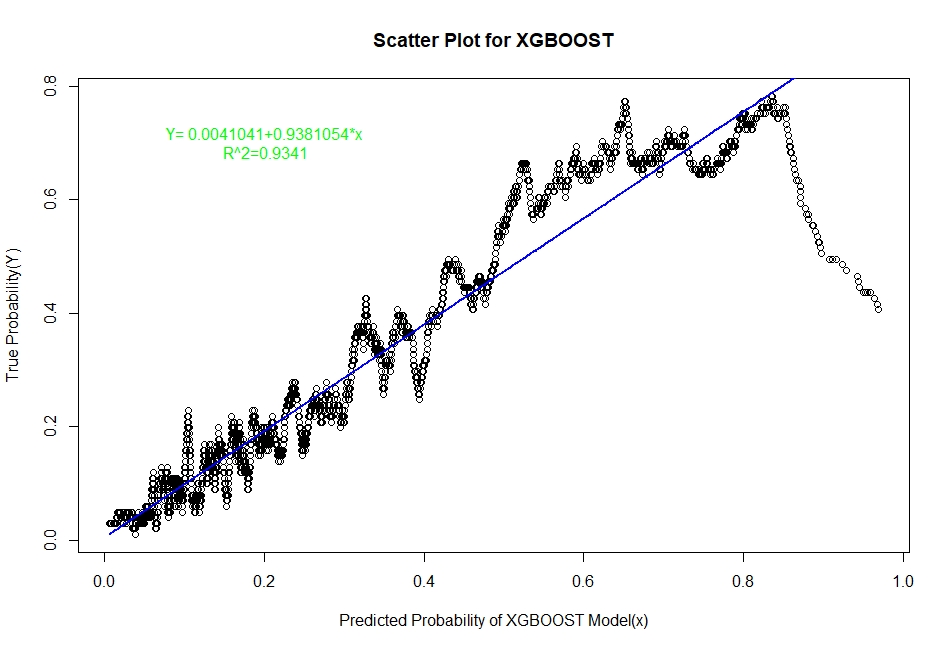

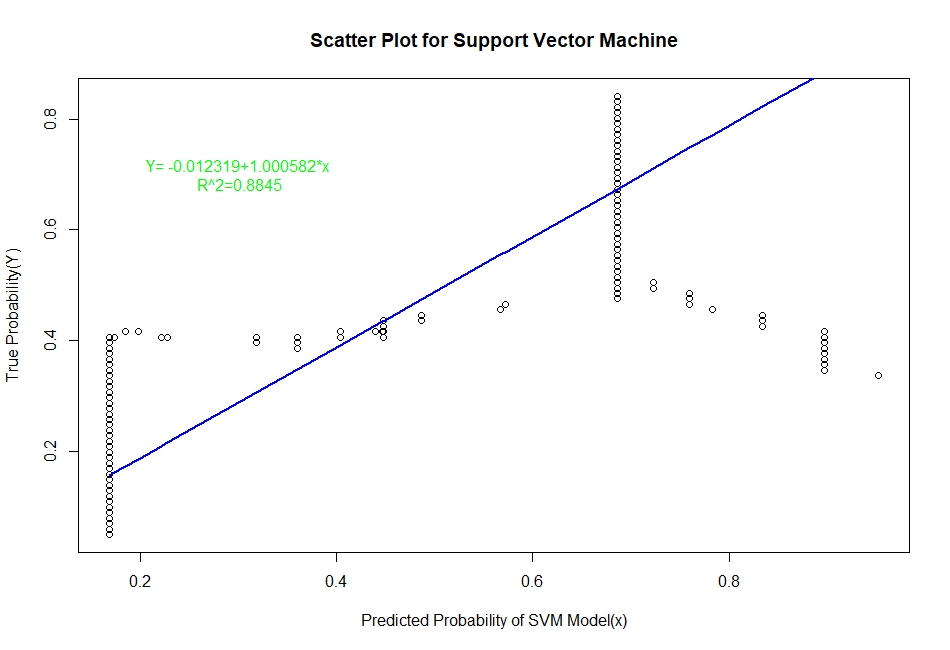

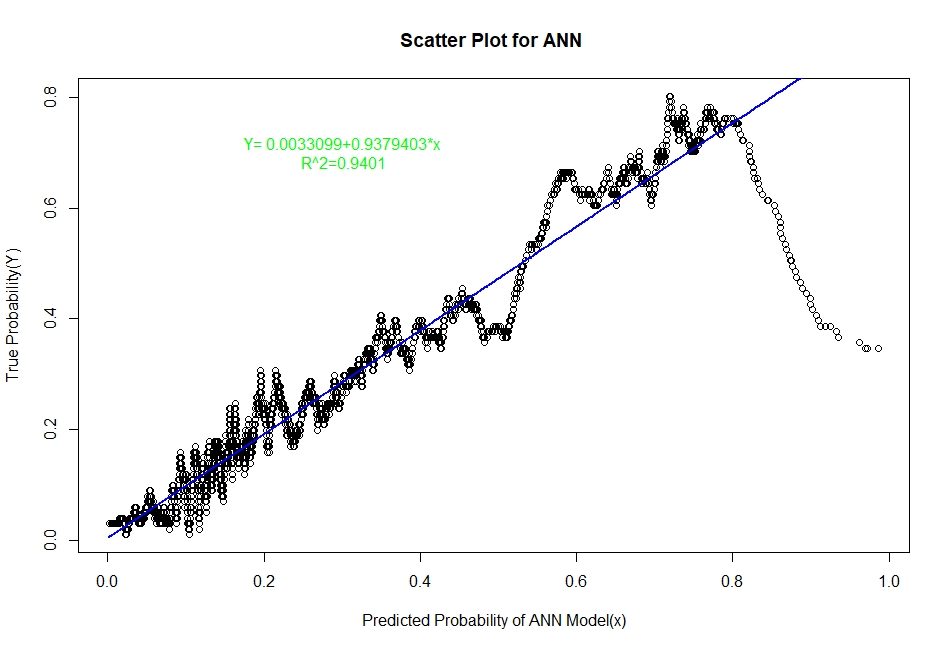

The scatter plots of real probability of default(estimated from Sorting Smoothing Method)(Y) versus the predicted probability from the model (x) along with the fitted linear regression line for each of the six classifiers are as follow:

Evaluation of Representation Accuracy of Real Probability of Default For The Six Classifiers

As mentioned above, we’ll evaluate the accuracy of predicted probabilities for the models based on the goodness of fit of the linear regression line Y=A+Bx, where Y is the estimated real probability from Sorting Smoothing Method and x being predicted probability from the models. The measures used are the following:

- Intercept

- Slope

- Adjusted R squared

#Model evaluation table ##

Prediction.eval=data.frame(Model=c("Logistic","LDA","KNN","XGBoost","SVM","ANN"),Intercept=c(0.00441,0.06426,0.0302506,0.0041041,-0.012319,0.0033099),

Slope=c(0.9724,0.7706,0.8448061,0.9381054,1.000582,0.9379403),Rsq=c(0.929,0.909,0.9112,0.9341,0.884,0.9401))

Prediction.eval

Model Intercept Slope Rsq

1 Logistic 0.0044100 0.9724000 0.9290

2 LDA 0.0642600 0.7706000 0.9090

3 KNN 0.0302506 0.8448061 0.9112

4 XGBoost 0.0041041 0.9381054 0.9341

5 SVM -0.0123190 1.0005820 0.8840

6 ANN 0.0033099 0.9379403 0.9401

From the above table it is clear that for the ANN classifier the intercept A is closest to zero and R² is highest and slope B is also quite close to 1. Therefore, the Artificial Neural Network model represents the real probability of default the best.

Summary of The Project

Among the six aforementioned classification techniques, the tree based boosting model i.e XGBoost has performed the best in terms of classification task based on error rate, and AUC measure. The differences among the error rates for the methods are not very significant, more or less same; however, the areas under ROC curve are quite distinct and our case AUC is of more significance in terms of accuracy since the target class that is default, has a very small proportion. XGBoost by nature generally performs very well for structured or tabular data and it has done so on our dataset as expected.

On the other hand, in terms of prediction accuracy of probability of default, the method produced by Artificial Neural Networks (ANNs) outperforms the other five classification techniques in terms of highest R squared value, regression coefficient (closest to 1) and intercept (closest to zero). Therefore, the classification technique derived from ANNs represents the real probability of default better than the other methods such as discriminant analysis, KNN. In general, ANN performs well in the area of pattern recognition and in a sense; this method has done exactly that, distinguishing a kind of pattern among the clients with credit card, default and non-default, by representing the real probability of default which is more important in risk analysis than just binary classification.